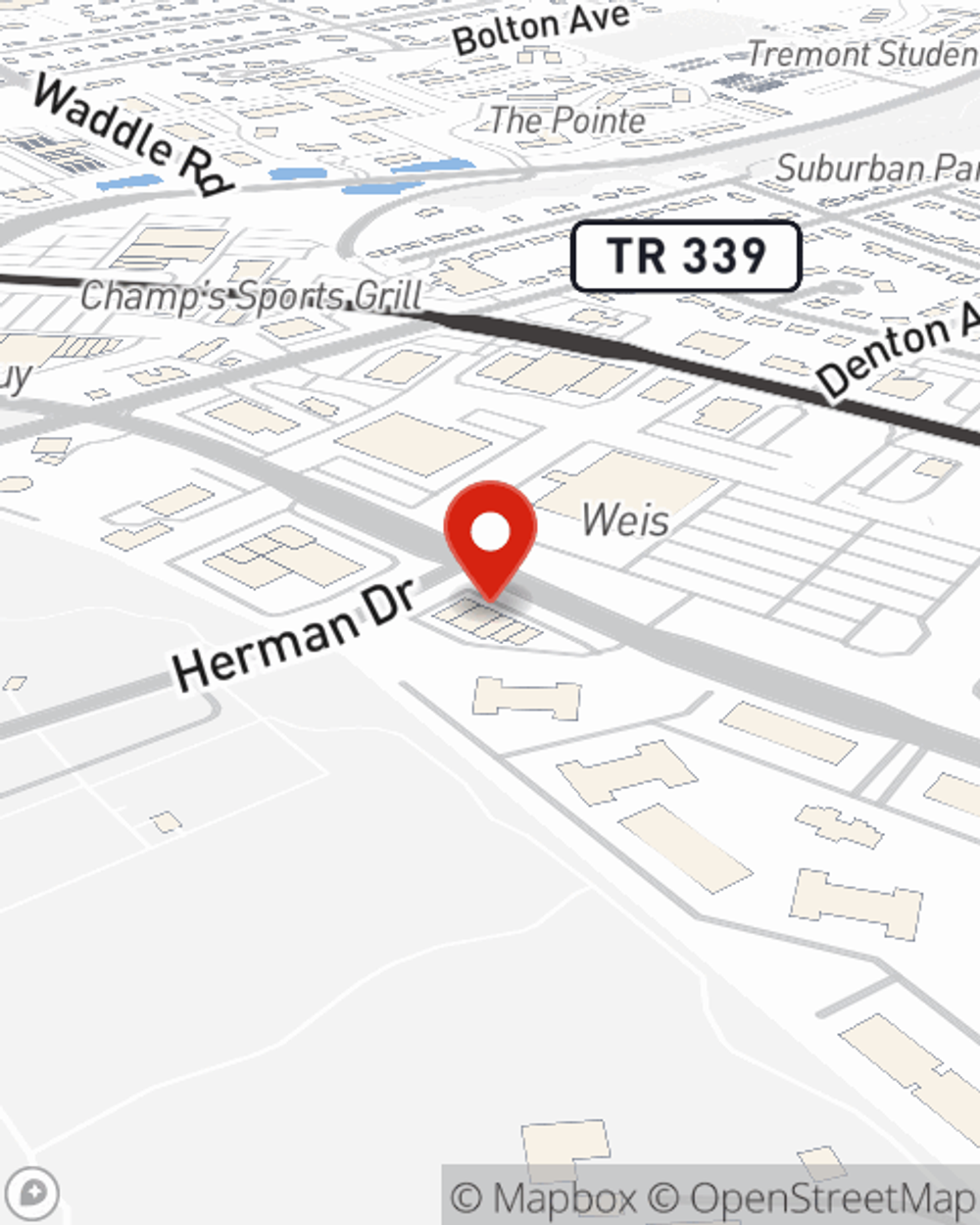

Business Insurance in and around State College

Calling all small business owners of State College!

Cover all the bases for your small business

Coverage With State Farm Can Help Your Small Business.

Running a business is about more than being your own boss. It’s a lifestyle and a way of life. It's a commitment to a bright future for you and for the ones you care for. Because you give your all to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with a surety or fidelity bond, business continuity plans and worker's compensation for your employees.

Calling all small business owners of State College!

Cover all the bases for your small business

Strictly Business With State Farm

When you've put so much personal interest in a small business like yours, whether it's a donut shop, a music school, or a kennel, having the right insurance for you is important. As a business owner, as well, State Farm agent Liz Dudek understands and is happy to offer personalized insurance options to fit the needs of you and your business.

Agent Liz Dudek is here to review your business insurance options with you. Visit with Liz Dudek today!

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Liz Dudek

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.